Investors

Risks and uncertainties

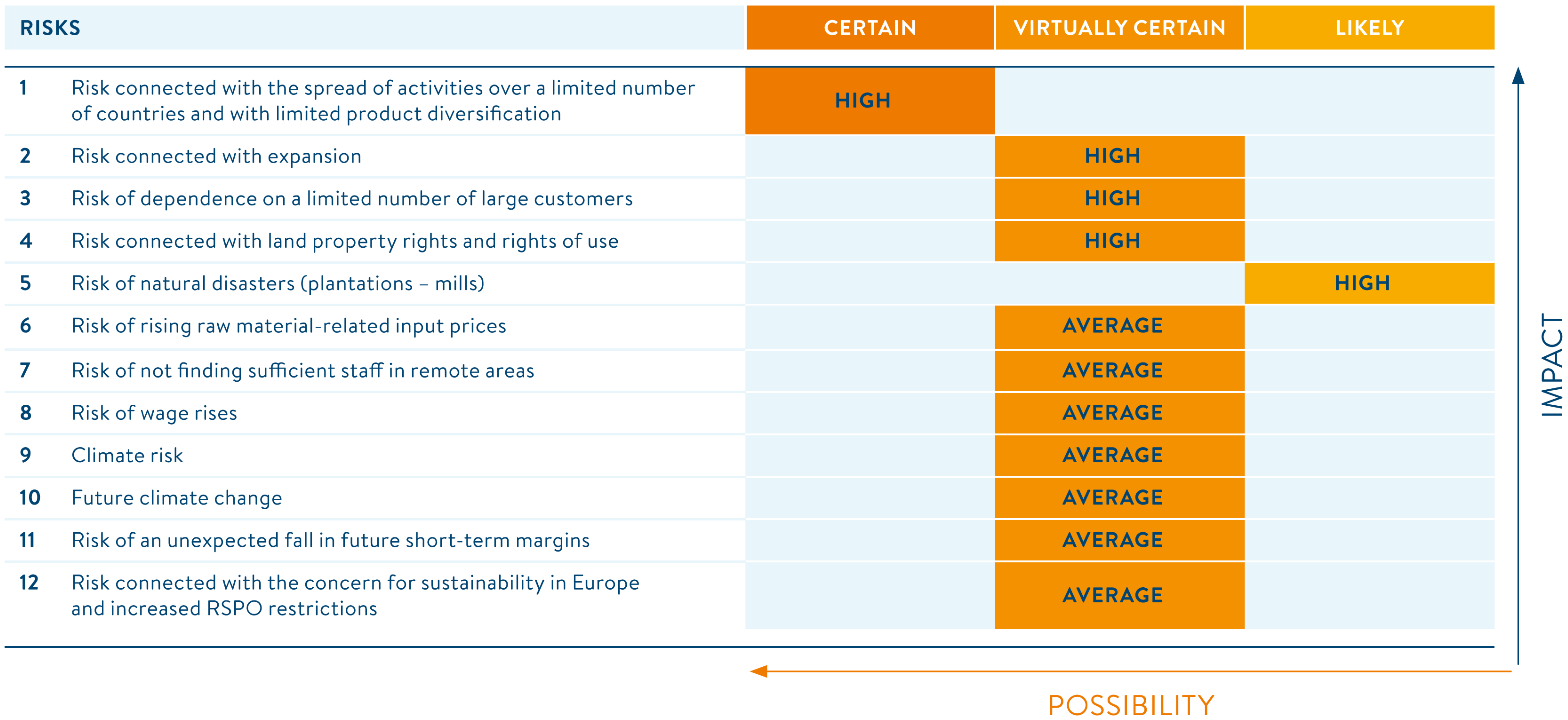

In November 2021, the Audit Committee conducted a further review of the risks facing the Group. As part of this process, the Committee identified and classified 76 risks within the following categories: general, product, operational, workforce, financial, commercial, legal, and political.

All identified risks were assessed according to their likelihood of occurrence and potential impact on the Company and were mapped accordingly. In response to developments during 2021, the Audit Committee revised the classification of certain risks compared with the 2020 assessment.

On the basis of this analysis, only those principal risks that are certain, virtually certain, or likely to occur within the SIPEF Group, and that could have a significant or moderate adverse impact on the Group’s financial position, operating results, or liquidity, including potential asset impairments, are set out below.

1. Description of the specific risks

The following specific risks were identified:

1.1. Risk connected with the spread of activities over a limited number of countries and with limited product diversification

The Group chiefly produces palm products, natural rubber, tea and bananas in Indonesia, Papua New Guinea and Ivory Coast. The centre of gravity of SIPEF’s activities is in the cultivation of oil palm products in Indonesia and Papua New Guinea, which accounts for approximately 92% of total turnover. So, if problems of any nature occur in Indonesia, and to a lesser degree in Papua New Guinea and Ivory Coast, to obstruct the cultivation or production of these products, this could have a significant negative impact on the results and the financial situation of the Group.

1.2. Risk connected with expansion

Limited availability of sites

The Group’s expansion strategy consists of, amongst others, of expansion by organic growth, by acquiring extra plots that can be planted and meet the requirements for RSPO certification. There is no certainty that the Group will be able to acquire on economically responsible terms, sufficient and agronomically suitable land which satisfies its sustainability policy. The acquisition of these areas, under ownership or through concession agreements, has become more difficult due to the limited availability of agricultural land and intense competition from other plantation companies. The limited availability of land for future expansion could have an adverse impact on the Group’s growth strategy.

Acquisitions, divestments, strategic alliances and joint ventures

Acquisitions, divestments, strategic alliances and joint ventures are an integral part of the Group’s growth strategy. However, there is no certainty that any of these transactions will be completed or will be favourable for the Group. As a result of any one of these transactions, the Group could, for example, face difficulties integrating new companies in other countries into its existing activities. In spite of due diligence, unforeseen legal, regulatory, contractual, labour-related and other problems may still arise to obstruct the integration advantages, quality levels and cost savings identified for the transaction in question.

1.3. Risk of dependence on a limited number of large customers

SIPEF sells approximately 96% of its crude palm oil (CPO), palm kernel oil (PKO) and palm kernels in the certified physical goods flows of the RSPO and International Sustainability and Carbon Certification (ISCC), for respective use in the food industry or for the production of green energy. It addresses a limited number of customers with whom it has built long-term relationships, and who are prepared to pay a premium for quality certification. In the future, SIPEF will continue to endeavour to supply 100% of its products in certified physical goods flows that are fully traceable. The Company counts on similar efforts from palm oil consumers, but has no certainty whatsoever about this.

1.4. Risk connected with land property and use rights

The retention of property rights and concession rights is essential for the Group to safeguard and develop the production in the various countries.

The Group’s activities and results could therefore be seriously impacted if it does not manage to retain these rights or, in the case of concession agreements, renew them for a long term. There is also a risk for the Group if the existing land use rights are limited.

1.5. Risk of natural disasters (plantations – mills)

Virtually all the activities of the Group are located in Indonesia and Papua New Guinea. These countries are volcanic areas where there is a great risk of natural disasters, such as earthquakes, landslides, mudflows and tsunamis. Ivory Coast, on the other hand, is sometimes affected by local tornados. All these natural disasters can have disastrous consequences for both plantations and mills. Furthermore, the plantations may have to deal with insect plagues or new plant and tree diseases, which can wipe out an entire harvest. Such disasters can have a material negative impact on the turnover and financial results of the Group.

1.6. Risk of rising raw material-related input prices

The main agricultural raw materials of the Group, such as fuel and fertiliser, are exposed to price fluctuations. These can have a significant impact on the Group’s costs and can accordingly have a negative impact on the Group’s operating results.

1.7. Risk of not finding sufficient staff in remote areas

The production of palm oil products, rubber, tea and bananas is very labour-intensive. The remote location of certain sites could make it difficult in the future to find staff prepared to work there.

1.8. Risk of wage rises

The costs of labour, staff and fringe benefits could rise by a significant degree in the future in countries in which the Group operates. Such rises could be the result of protective regulations imposed by local authorities. As the Group’s activities are very labour-intensive, unexpected rises could generate a great cost and put a serious strain on the Group’s results.

1.9. Climate risk

The volumes produced, the turnover and margins generated are impacted by climate conditions, such as precipitation, sunshine, temperature and humidity. Unfavourable weather can disrupt the agricultural activities and have a negative impact on agricultural production. Severe weather, e.g. floods, droughts, storms, could result in significant damage to property, protracted interruptions to the activities, personal injury and other damage to the operations of the Group.

The potential physical consequences of climate are uncertain, and may differ depending on the region and the product.

1.10. Future climate change risk

Earth’s climate is changing. As average temperatures rise, acute hazards, such as heat waves and floods, grow in frequency and severity, and chronic hazards, such as droughts and rising sea levels, intensify. While companies and communities have been adapting to reduce the impact of climate risk, the pace and scale of adaptation are likely to need significant increase to manage rising levels of physical climate risk.

As climate change is shifting ecosystems, it will have an effect on the planet and livelihoods, and pose a risk to food production. Therefore, adaptation is likely to entail rising costs, and choices need to be made on how to build the resilience of businesses.

In the face of these challenges, policy makers and decision makers will need to put in place the right framework, processes and governance to reduce the further build-up of climate risk, by issuing business regulations or classification systems, such as the EU taxonomy, as well as tax and penalty systems. Moreover, financial institutions could define their investment and loan policy based on the climate change risk, denying financial resources to companies which do not integrate sufficiently their strategy for adaptation to and mitigation of this risk.

1.11. Risk of an unexpected fall in future short-term margins

The turnover and margins generated depend to a great degree on fluctuations in market prices, primarily of CPO and CPKO. Economic factors the Group has no control over affect the supply of and demand for these products, as well as their prices. There is a risk that such fluctuations will have an adverse impact on the Group’s profitability. Based on the 2022 budget, a change in the CPO price of USD 100 CIF Rotterdam per tonne would impact the post-tax result by approximately USD 31.5 million per year, not including the impact of export duties.

1.12. Risk connected with the concern for sustainability in Europe and increased RSPO restrictions

The Group’s reputation is based on its RSPO certification. Given the growing consumer concern for sustainability and corporate social responsibility, the European Union or the various authorities in the countries in which SIPEF operates could impose tougher rules on companies. It is uncertain whether the Group and the local producers will always be able to comply with these certification requirements. If the Group fails to meet the requirements, it could lose its certification, or have it suspended. Such loss or suspension would have an adverse impact on the activities, reputation and financial situation of the Group.

None of the aforementioned risks are insured, except for the risk to mills in connection with natural disasters. For this risk, insurance has been taken out to cover the potential damage to the buildings, systems, tools and products physically present in the factories.

2. Description of the general risks

As well as the specific risks, the Group also has to contend with more general risks associated with:

- currency, interest rates, credit and liquidity;

- social actions;

- computer systems;

- regulations;

- court cases;

- internal control;

- tax audits;

- environmental liability.

Currently, there is a progressive tax plus levy on every palm oil export out of Indonesia. The price of sales to Indonesian customers is also impacted by this levy, given the local population is not prepared to pay more than the net export price. These levies, therefore, have a major direct and indirect impact on all palm oil produced by SIPEF in Indonesia.

In December 2020, this tax and levy were increased substantially, due to the application of a new export levy matrix for palm products. The higher tax was passed to finance the Indonesian government’s biodiesel programme. That meant that the export tax and levy increased significantly in 2021 compared with 2020, to on average USD 349 per tonne in 2021, compared with USD 74 per tonne a year earlier. This equated to a rise of USD 275 per tonne compared with the previous system.

The continuing rise in CPO prices in the course of the first half of the year led to the easing of the export levy mechanism on 2 July 2021. The levy and tax will be calculated by the government on a monthly basis, based on the applicable palm oil prices on the international markets.

There is also a potential risk of unexpected taxation in Papua New Guinea.